Introduction to temperature scoring and portfolio coverage methods

Three methods are currently supported by the SBTi for setting targets on scope 3 portfolio emissions: the Sectoral Decarbonization Approach (SDA), the SBT Portfolio Coverage, and the SBT Temperature Scoring. The latter two methods, Portfolio Coverage and Temperature Scoring, require assessing the targets disclosed by the companies within a financial institution’s portfolio.

Financial institutions may use the portfolio coverage and/or temperature scoring methods to set targets for their corporate instruments, including corporate debt, listed equity and bonds, and private equity and debt (See relevant “Required Activities” in Table 5-2 of the SBTi guidance to drive adoption of science-based targets).

To use the portfolio coverage method, financial institutions commit to engaging with their investees to set their own approved science-based targets, such that the financial institution is on a linear path to 100% SBT portfolio coverage by 2040. As the fulfillment of portfolio coverage targets mean that investees’ SBTs have been approved by SBTi, the 2040 timeline has been determined to allow companies enough time to implement their target to ultimately achieve an economy-wide transition to net zero by 2050.

To use the temperature scoring method, financial institutions determine the current temperature score of their portfolio based on the public GHG emission reduction targets of their investees (these targets include SBTs and any other valid public GHG targets that meet the method criteria). Financial institutions set targets to align their base year portfolio temperature score to a long-term temperature goal (e.g. 2°C, well-below 2°C, 1.5°C). The temperature scoring method is an open source framework to enable the translation of corporate GHG emission reduction targets into temperature scores at a target, company, and a portfolio level. The method provides a protocol to enable the aggregation of target level scores to generate a temperature rating for a company based on the ambition of its targets. Finally, the method defines a series of weighting options that can enable financial institutions and others to produce portfolio level temperature ratings.

Why has SBTi built this tool?

There has been a growing interest in methods to measure the alignment of companies and investment portfolios with the Paris Agreement. The success of the Science Based Targets initiative has seen a rapid growth in the number of companies with emission reduction targets approved by the SBTi, and therefore, a growing number of companies claiming alignment to the long term temperature goals set out in the Paris Agreement.

The SBTi has developed a codebase to function as a calculator for the portfolio coverage and temperature scoring methods. This tool is fed with the necessary data to generate temperature scores at the company and portfolio level, in addition to providing analytics on target setting and company emission reduction ambitions. It also gives users access to what-if analysis, to aid their decision-making process. The code reflects the logical steps that are outlined in the publicly available *temperature scoring methodology*, developed by *CDP* and *WWF*.

The tool was created to enable the widespread implementation of the method by data providers and financial institutions, to work with any data source and in most IT environments. For each method, the tool provides the following outputs:

Portfolio coverage: generate the % of the portfolio currently covered by SBTi-approved targets.

Temperature scoring: generate the current temperature score of the portfolio (in addition to the individual temperature scores of the portfolio companies). It also enables the generation of a series of what-if scenarios to showcase how this temperature score could be reduced.

Why have we built the SBTi-Finance tool in this way?

To help financial institutions fight climate change, SBTi wants the tool to be accessible, useful, and used by as many finance professionals and other users as possible. If it is easy to access, not seen as a compliance tool only used once a year, but a tool to support the investment process, it is more likely it will be utilized widely. Therefore, when SBTi started the development process we set up a list of requirements for the tool. Some of the high-level requirements were:

Distribution – most investment professionals should have easy access to the tool

Transparent – with full output audit trail and open methodology

Data agnostic – to be used with any data provider or an institution’s own data lake

Any infrastructure – to be integrated with service providers’ or homegrown decision support solutions

Workflow tool – to be integrated in investment professionals’ daily workflow

Data security – to make sure financial portfolio data is not compromised

Scale – be able to use the tool at scale for many portfolios and aggregated on financial institution level

Continued development – ensure enhancement of the method and tool for future requirements

Given these requirements, the SBTi determined an open-source Python-based solution to be most appropriate. Such tool can be integrated into existing solutions, in many cases making use of the same secure infrastructure as inhouse or commercial applications. As the tool pulls data from existing integration of data providers and/or internal data lakes, there is no need to go outside of this infrastructure to access or deliver necessary data. Hence, no data that is not already within the institution’s domain needs to enter or exit the institution to use the tool. The approach brings the model to the data, rather than the other way around.

SBTi-Finance launched an RfP for building the codebase to turn the methodology into a calculation engine early 2020. The selected SBTi-Finance tool development project partners are Ortec Finance and the OS-Climate.

To make sure we built a tool that from the outset could work in as many different environments and for as many different users as possible, we reached out to users and data and service providers and invited them to work with us in our project team. This gave both users and data providers the opportunity to influence the development process and to prepare and develop their own solutions, data, and processes to work with the tool. This has been very helpful in getting their perspectives, to make sure the tool work with as many data providers’ data as possible and that it fits with many users’ existing workflow.

A strong confirmation of the various tool use cases is that fact that a number of data/service providers have developed or are in the process of developing various solutions based on the tool and the methodology, to offer their clients. This collaboration also gives the SBTi-Finance tool a wider reach than what the SBTi could have achieved otherwise and the tool should be available natively in their existing infrastructure for a significant proportion of the financial institutions globally. This integration should also ensure that the tool can be used at scale, to help large and small financial institutions alike to quickly analyze all their portfolios’ and constituents’ temperature scores.

The open-source nature of the codebase means that any user, data- or service provider can use the code to build their own applications around the SBTi-Finance Tool. It also means that it is available for any user to integrate into their own infrastructure, without any licensing cost. This should also ensure that the code continues to be developed both by the SBTi, data and service providers and the open source community.

The tool also provides full transparency with regards to how the tool and methodology fit together through the open-source nature of both the codebase and the methodology. We also have provided easy to use functionality to extract every single data point generated by the tool, to provide a full audit trail and transparency into how the temperature score is calculated.

During Summer 2020 we ran a public beta-testing phase open to any organization or individual. The beta-testing phase included more than 110 registered beta-testers. Users provided feedback on the tool’s functionality, documentation requirements, performance, and usability. This feedback has been incorporated in the final release version.

Altogether, our conversations with users and data providers and the feedback from 110 beta testers indicates that the development process and the structure of the SBTi-Finance Tool has the potential to become an integrated experience and that it could become as natural for a portfolio manager or analysts to use as their DCF model or attribution report. In turn, this should ensure that portfolio and company temperature scores stay top-of-mind for finance professionals and that this ultimately leads to more efficient engagement processes and GHG emissions reductions in the real economy.

What can I use the SBTi-Finance tool for?

The SBTi-Finance Temperature Scoring and Portfolio Coverage tool enables analysis of companies, sectors, countries, investment strategies and portfolios to understand how they contribute to climate change. You can for example:

Measure your portfolio’s current temperature score

Identify the biggest contributors on an individual company, country, and sector basis

Use the tool as an aid for strategic allocation and securities selection decisions

Analyze what effect changes in your portfolio might have on the portfolio temperature score

Model impact of engagement on your temperature score, that is, how your score can improve if you are able to convince an investee company to set or improve GHG emissions reduction targets

Identify which company engagements would have the biggest impact on your portfolio’s temperature score

Plan engagement strategies based on your modelling

Fulfil regulatory reporting criteria, e.g. Article 173 in France and the EU Disclosure regulation, regarding current portfolio alignment with Paris Agreement

Help you to create an action plan for reaching your emission reduction target

Given these possible insights, as confirmed by our beta testing survey, the tool is relevant for a wide range of stakeholders. For instance:

Portfolio managers - to support strategic allocation decisions and input into ESG discussions with corporate management

Financial analysts - to use the temperature score as an input into the cost of capital for valuation modelling

ESG analysts - to plan and execute corporate engagement strategies

Risk managers – for input into climate related risk models

Compliance officers – for EU Disclosure regulation and Article 173 reporting

Data and service providers – to provide company temperature scores and portfolio analytics for their users

CIOs – to help to understand the portfolios’ ESG position

NGOs – for further research to enhance climate related methodologies

What data do I need to use the tool?

The tool itself is data agnostic and has no built-in databases. This means that users need to import all needed data to perform the analysis and can use any data source with the necessary data available. This data can come from a variety of sources but must be inputted in the required formats. The data providers that we have worked with during the development, have built or are in the process of building solutions to help with this process. Four types of data are needed to run the tool. These are described in the table below.

Portfolio holdings |

|

Corporate GHG Targets |

This refers to the data required to analyze a corporate GHG emissions reduction targets, including:

|

Corporate GHG Emissions Data |

Scope 1+2 and scope 3 emissions data, reported or modelled. |

Corporate Financial data |

Seven weighting option are currently available to aggregate company scores to produce portfolio scores. Depending on the option chosen, the following data may be required:

|

See Data Requirements section for more detailed information.

Also refer to the full methodology for temperature scoring.

Where can I find the data?

Commercial data providers such as Bloomberg, CDP, ISS, MSCI, TruCost and Urgentem can provide some or all the data needed for the SBTi-Finance Tool.

There is also a free data set available with corporate GHG targets data on SBTi’s website. This includes data of all the companies that have set emissions reduction targets that have been approved by SBTi and is updated on a weekly basis. You can download an Excel-file with the data here: *https://sciencebasedtargets.org/companies-taking-action/*.

It is likely that your portfolio includes companies that are not in the list of companies with SBTi-approved targets, but that have publicly announced targets. Commercial data providers such as those listed above can provide target data for these companies.

Overview of how the tool works

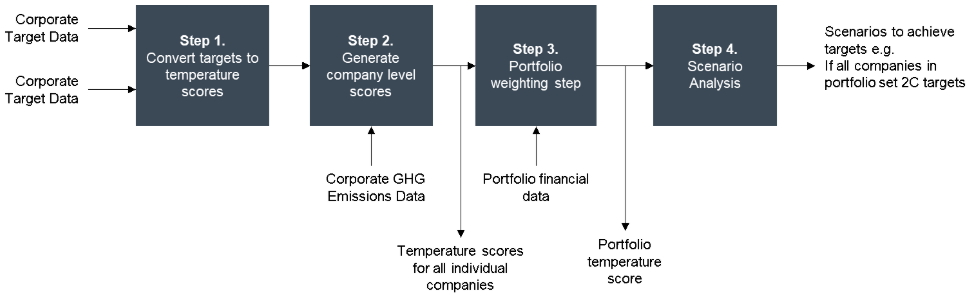

The calculation methodology consists of four key steps, each requiring specific data points that are inputted at the beginning of the process. These data points are then used to convert the corporate GHG emission reduction targets into temperature scores at the company and the portfolio level.

Step 1: Converting publicly stated targets to temperature scores. The targets are first filtered and are - if valid - translated to a specific temperature score, based on the relevant regression model [Section 1.3 in the methodology]. The sector classification of the company is used to ensure that the target is correctly mapped to the appropriate regression model e.g. a target for power generation must be mapped to the power sector pathway and corresponding regression model. This process enables the translation of target ambition over a certain target time period into a temperature score. For example, a 30% reduction target in absolute GHG emissions over 10 years can be converted into a temperature score of 1.76°C. It should be noted that those companies without a valid target are assigned a default temperature score [Section 1.4 in the methodology], rather than being excluded from the analysis.

Step 2: Aggregate across targets (if applicable) to a company level temperature score. Reported corporate GHG emission data is employed to aggregate company level temperature scores.

Step 3: Aggregate individual company temperature scores to portfolio level scores. All the individual temperature scores per company in a portfolio are then combined with portfolio financial data to generate scores at the portfolio level.

Step 4: Run what-if analysis via the scenario generator. After the initial score calculations, a scenario generator can be used to determine how certain actions, e.g. engagement, can change the portfolio temperature score over time. When running these what-if scenarios, the temperature score is recalculated with the assumption that, based on various engagements, some or all the companies in the portfolio decided to set (more ambitious) targets. The following what-if analyses are included in the tool:

Scenario 1 |

In this scenario all companies in the portfolio that did not yet set a valid target have been persuaded to set 2.0 Celsius (C) targets. This is simulated by changing all scores that used the default score to a score of 2.0C. |

Scenario 2 |

In this scenario all companies that already set targets are persuaded to set “Well Below 2.0C (WB2C) targets. This is simulated by setting all scores of the companies that have valid targets to at most 1.75C. |

Scenario 3 |

In these scenarios the top 10 contributors to the portfolio temperature score are persuaded to set 2.0C targets.

|

Scenario 4 |

In this scenario the user can specify (by adding “TRUE” in the engagement_targets-column in the portfolio data file) which companies it wants to engage with to set 2.0C or WB2C targets.

|

What are the outputs the tool generates?

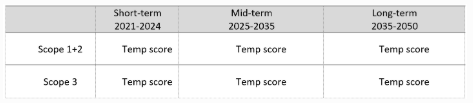

The temperature score can be calculated for all time frames (short, medium, long term) and scope (Scope 1, 2, 3) combinations covered by the SBTi methodology. The table below provides an overview of these:

The temperature score calculation is available for the following levels:

Portfolio temperature score: the aggregated score over all companies in the portfolio

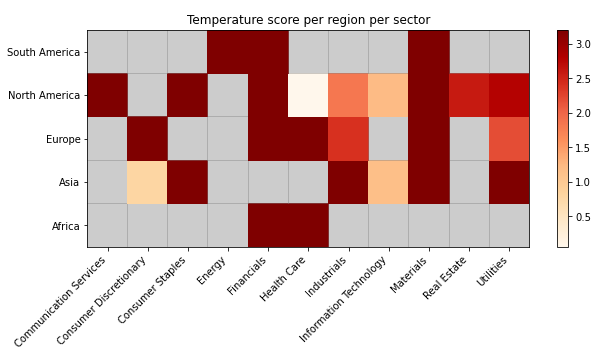

Grouped temperature score: using the “group by” option, the user can get the aggregated temperature score per category in a chosen field (e.g. per region or per sector).

Company temperature score: the temperature score of an individual company

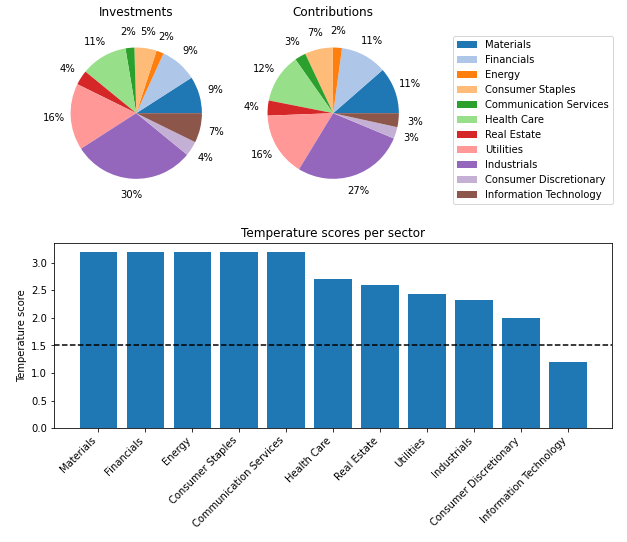

The figure below provides illustrative outputs for grouped temperature scores by region and sector. These insights help inform use cases such as more targeted engagement strategies, aiding securities selection decisions, etc.

*Illustrative output of the temperature score on portfolio level, grouped by region and sector*

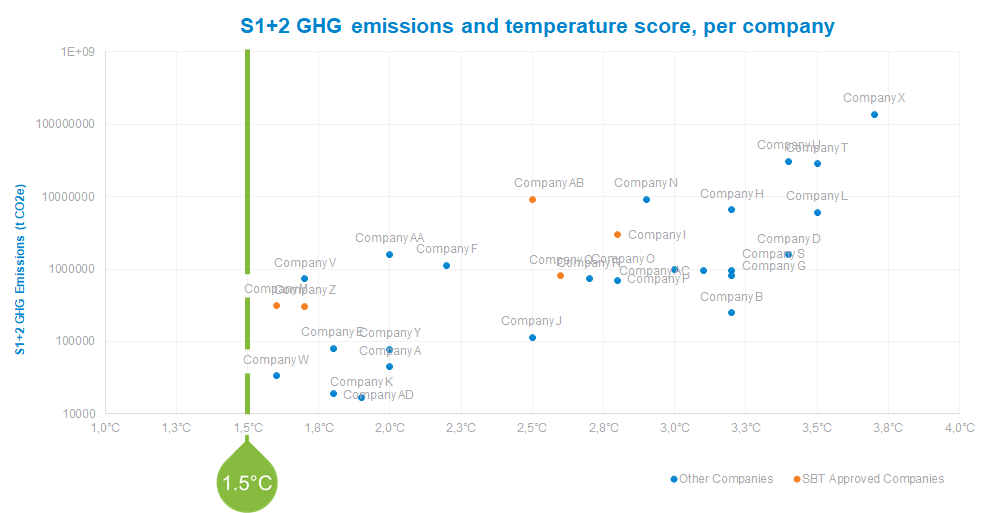

The next figure provides a visualization of the outputs when looking at the temperature score per company. This level of granularity of the tool enables users to zoom in on individual scores for, e.g. informing engagement and/or monitoring temperature score progress of investees.

*Illustrative visualization of the temperature score outputs per company*

For the portfolio temperature score and the grouped temperature score, additional more granular information is reported about the composition of the score:

Contributions: the level to which each company contributes to the total temperature score based on the chosen aggregation method. This value is split up into company temperature score and relative contribution (for example the weight of the investment in the company relative to the total portfolio when using the WATS aggregation method).

The percentage of the score that is based on targets vs. the percentage based on the default score

For the grouped temperature scores: the percentage each group contributes to the portfolio temperature score. For example: how much each region or sector contributes to the total score.

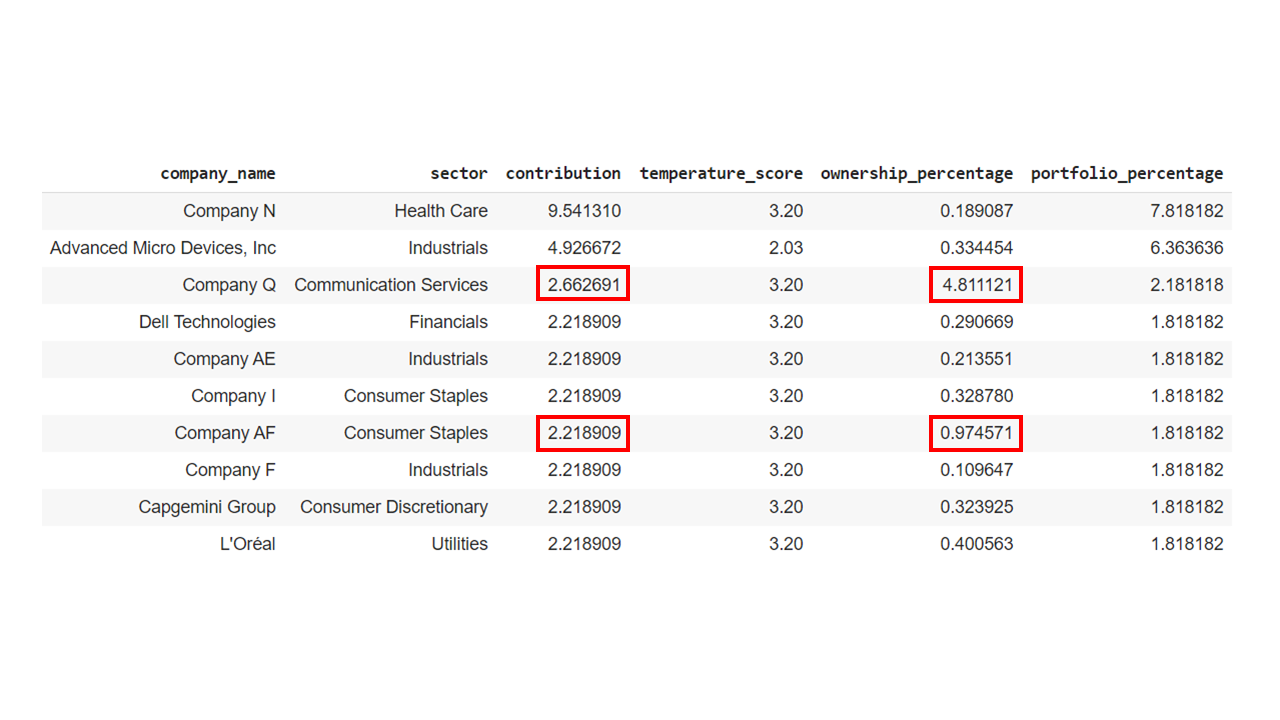

The table below, taken from a Jupyter Notebook implementation of the tool (see ,https://sciencebasedtargets.github.io/SBTi-finance-tool/ for executing your own rungs of the Jupyter Notebook), highlights the companies with the highest contribution to the portfolio temperature score and at the same time displays ownership and portfolio weight to give the user an indication of where an engagement may be more successful, purely from a quantitative perspective.

*Illustrative output table of the temperature score and contribution analysis on company level*

The figure below depicts similar analysis in a more visual format. What can be seen in the figure is the relative contributions to the sector temperature scores.

*Illustrative visualization of the temperature score outputs and contribution results grouped per sector*

For the company temperature scores, you can let the tool generate all underlying data, which provides full transparency and gives the user the full audit trail for how the final temperature score has been calculated. This data output provides:

Portfolio data

Financial data

GHG emissions

Used target and all its parameters

Values used during calculation such as the Linear annual reduction (LAR), mapped regression scenario, and parameters for the formula to calculate the temperature score.

You can also anonymize the output data, which removes all names and identifiers. This is particularly useful for sharing results of your temperature score without having to reveal your holdings, for example for submitting your temperature score to the Target Validation Team (TVT) at SBTi to get your own GHG emissions reduction target approved. At the same time, it provides the opportunity to audit the scores during the validation process.

For a more detail please see Jupyter notebook examples found here.